Long-term investing requires a long-term perspective, and buy-and-hold doesn't fit the bill. Below are some tools and strategies that can be useful for long-term investors. You need to find an investment strategy that is right for you. This will help you avoid costly mistakes that could lead to a loss of investments. Here are four common mistakes new investors make when trying to invest for the long-term. These are some tips to help you avoid making the same mistakes.

Investment horizons

Although investing has many risks, long-term investments are generally more profitable. Short-term investors should concentrate on secure, guaranteed investments. Long-term investors should invest in a mixture of stocks and bonds. Although market volatility may increase over the short-term, market risk tends to decrease over time. Long-term investors often invest in a combination of stocks and bond, but they may still choose riskier assets.

Asset classes

Most investments fall into one of five asset classes: bonds, stocks, and cash. Although each asset class has a different risk level, the majority are considered conservative. Short-term CDs and U.S. Treasury Bills are cash equivalents. Stocks are more risky. Another class of investments is fixed income, such as bonds and bond funds. Real estate is the middle of the risk spectrum.

Strategies

Long-term investments are more manageable than short-term. They can rely on a trusted financial adviser to help them manage their investments, and to make adjustments when necessary to ensure they're growing at a suitable rate. Stocks, mutual funds and ETFs are all common long-term investments. Stocks can be considered ownership of a company. They also grant voting rights to the investor and allow them to share in its profits.

Tools

Modern investing tools make it easier than ever to analyze stocks, and help you make better investment decisions. Gurufocus' visual graphs and data derived from SEC reports make it easier to understand the market impact. Even better, there are tools that can help you track your investments in a certain time-frame. Before you decide to invest your money in a specific stock, however, there are important factors that you should take into consideration. Here are some tools you should consider using when you are considering a long-term investment strategy.

Teamwork

It is essential to establish goals and clearly define the roles and responsibilities of team members in order to improve teamwork. Ask your team what teamwork looks and what they want to achieve together. Clearly state your goal and then be specific about how you plan to accomplish it. You should set specific dates for each goal. By doing so, you will make it easier to monitor progress and improve the process. Once you have established the team's goals you can start to set the next steps.

FAQ

Do I need to know anything about finance before I start investing?

No, you don’t have to be an expert in order to make informed decisions about your finances.

All you need is common sense.

These tips will help you avoid making costly mistakes when investing your hard-earned money.

First, be careful with how much you borrow.

Do not get into debt because you think that you can make a lot of money from something.

It is important to be aware of the potential risks involved with certain investments.

These include inflation, taxes, and other fees.

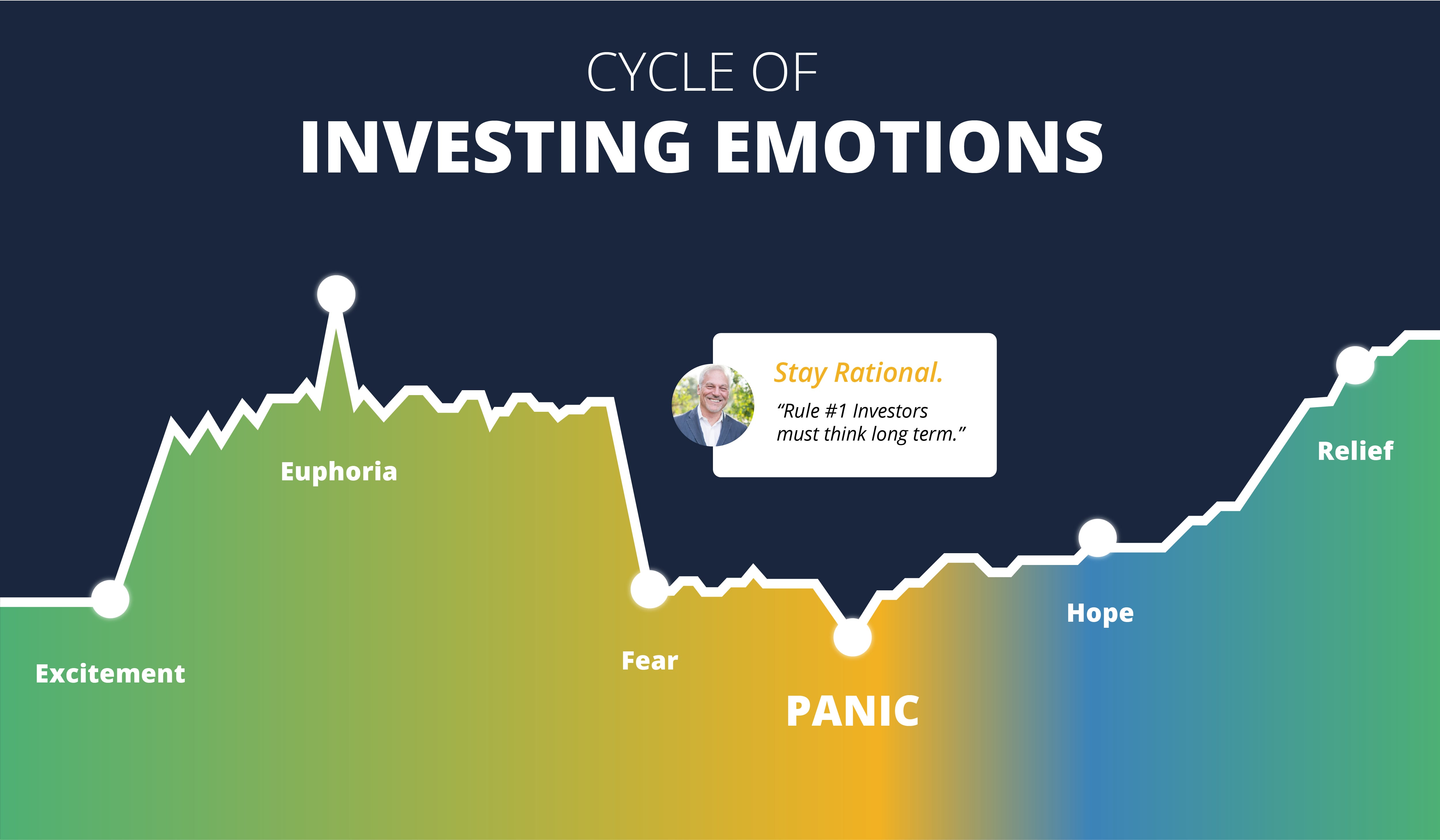

Finally, never let emotions cloud your judgment.

Remember, investing isn't gambling. To succeed in investing, you need to have the right skills and be disciplined.

These guidelines are important to follow.

What is the time it takes to become financially independent

It depends on many variables. Some people become financially independent immediately. Others may take years to reach this point. It doesn't matter how long it takes to reach that point, you will always be able to say, "I am financially independent."

You must keep at it until you get there.

Which fund would be best for beginners

When investing, the most important thing is to make sure you only do what you're best at. FXCM, an online broker, can help you trade forex. If you are looking to learn how trades can be profitable, they offer training and support at no cost.

If you are not confident enough to use an electronic broker, then you should look for a local branch where you can meet trader face to face. You can also ask questions directly to the trader and they can help with all aspects.

Next would be to select a platform to trade. CFD and Forex platforms are often difficult choices for traders. Both types trading involve speculation. Forex is more reliable than CFDs. Forex involves actual currency conversion, while CFDs simply follow the price movements of stocks, without actually exchanging currencies.

Forex is much easier to predict future trends than CFDs.

Forex can be volatile and risky. For this reason, traders often prefer to stick with CFDs.

We recommend you start off with Forex. However, once you become comfortable with it we recommend moving on to CFDs.

Statistics

- According to the Federal Reserve of St. Louis, only about half of millennials (those born from 1981-1996) are invested in the stock market. (schwab.com)

- Most banks offer CDs at a return of less than 2% per year, which is not even enough to keep up with inflation. (ruleoneinvesting.com)

- 0.25% management fee $0 $500 Free career counseling plus loan discounts with a qualifying deposit Up to 1 year of free management with a qualifying deposit Get a $50 customer bonus when you fund your first taxable Investment Account (nerdwallet.com)

- They charge a small fee for portfolio management, generally around 0.25% of your account balance. (nerdwallet.com)

External Links

How To

How to invest stocks

Investing has become a very popular way to make a living. It is also considered one the best ways of making passive income. There are many ways to make passive income, as long as you have capital. There are many opportunities available. All you have to do is look where the best places to start looking and then follow those directions. The following article will explain how to get started in investing in stocks.

Stocks are shares that represent ownership of companies. There are two types. Common stocks and preferred stocks. Prefer stocks are private stocks, and common stocks can be traded on the stock exchange. Shares of public companies trade on the stock exchange. They are priced based on current earnings, assets, and the future prospects of the company. Stocks are bought to make a profit. This is known as speculation.

There are three key steps in purchasing stocks. First, decide whether you want individual stocks to be bought or mutual funds. Second, select the type and amount of investment vehicle. The third step is to decide how much money you want to invest.

Choose whether to buy individual stock or mutual funds

If you are just beginning out, mutual funds might be a better choice. These portfolios are professionally managed and contain multiple stocks. Consider how much risk your willingness to take when you invest your money in mutual fund investments. Some mutual funds have higher risks than others. If you are new or not familiar with investing, you may be able to hold your money in low cost funds until you learn more about the markets.

If you prefer to invest individually, you must research the companies you plan to invest in before making any purchases. Check if the stock's price has gone up in recent months before you buy it. The last thing you want to do is purchase a stock at a lower price only to see it rise later.

Select Your Investment Vehicle

Once you've decided whether to go with individual stocks or mutual funds, you'll need to select an investment vehicle. An investment vehicle can be described as another way of managing your money. You could for instance, deposit your money in a bank account and earn monthly interest. You could also open a brokerage account to sell individual stocks.

Self-directed IRAs (Individual Retirement accounts) are also possible. This allows you to directly invest in stocks. The self-directed IRA is similar to 401ks except you have control over how much you contribute.

Your investment needs will dictate the best choice. Are you looking for diversification or a specific stock? Are you looking for stability or growth? How comfortable do you feel managing your own finances?

The IRS requires all investors to have access the information they need about their accounts. To learn more about this requirement, visit www.irs.gov/investor/pubs/instructionsforindividualinvestors/index.html#id235800.

You should decide how much money to invest

Before you can start investing, you need to determine how much of your income will be allocated to investments. You have the option to set aside 5 percent of your total earnings or up to 100 percent. The amount you choose to allocate varies depending on your goals.

For example, if you're just beginning to save for retirement, you may not feel comfortable committing too much money to investments. If you plan to retire in five years, 50 percent of your income could be committed to investments.

It is crucial to remember that the amount you invest will impact your returns. So, before deciding what percentage of your income to devote to investments, think carefully about your long-term financial plans.